Unlike ebay, Amazon offers various marketplaces in EU countries. Here is an overview of the marketplaces.

- Italy:

Amazon.it - Spain:

Amazon.es - France:

Amazon.fr - Great Britain:

Amazon.co.uk

Do you want to see all EU-wide Amazon offers directly on one page? Then use our EU price comparison!

Amazon ordering in the EU – Amazon.es/fr/it/co.uk

Go to one of the Amazon marketplaces mentioned above, e.g. https://www. amazon.es

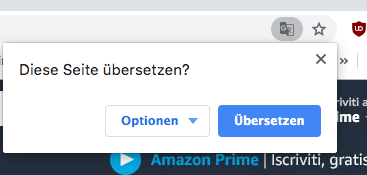

Unlike on the German Amazon site, where you can also set the language to English, Amazon Spain does not offer a translation of the site.

Therefore, use “Google Translate”. In Chrome, for example, the following pop-up appears when you enter Amazon.es:

Otherwise, the marketplaces work like Amazon.de.

Important: When searching, bear in mind the language of the marketplace.

So you won’t get any results if you search for“vacuum robot” on Amazon.es, for example. Instead, you need to select the Spanish search term“robot aspirador” to get results.

Our price comparison will make your work easier. You can use German search terms as usual and receive results for all Amazon EU marketplaces.

So you don’t have to search in Spanish, French, Italian and English.

Save sales tax – Amazon as a seller

If you purchase an item directly from Amazon in another EU country, Amazon will only charge you the German VAT rate of 19%.

The automatic recalculation of VAT takes place in the last order step. Amazon deducts the foreign VAT from the price and adds the German VAT to the price.

For example, if you buy an ASUS notebook from Amazon.es for 599.99 euros, Amazon deducts the Spanish VAT of 21% (= 495.04 euros) and charges 19% VAT. again (= 590.07 euros). This results in a saving of 9.92 euros compared to the previous Spanish price.

Have sales tax refunded

As an entrepreneur, you have the advantage of receiving an invoice with German VAT from Amazon. You can submit these to the tax office as usual and receive a VAT refund.

Sales tax at Amazon Marketplace

If you do not buy directly from Amazon as a seller, but from a Marketplace retailer, you will pay foreign VAT. There is no harmonization of VAT with German VAT. Entrepreneurs have the option of having VAT paid within the EU refunded.

Advantages over ebay

Shopping on Amazon offers advantages over ebay if you shop across borders. If Amazon is the seller, the price will be reduced again in the final order step. Why is that? Amazon deducts the foreign VAT from the price and only charges the German VAT. Germany has the lowest VAT rate in the EU (see VAT rates).

Another advantage is that Amazon has low shipping costs (see example EU shipping costs). For example, only €7.28 is charged for shipping a notebook from Italy (as of 2020). On ebay, shipping the same device costs 15 euros.

Disadvantages compared to ebay

The EU-wide search for offers is made very difficult as there is no platform with an overall offer. The prices must be queried for each individual country. In addition, as a German customer, you are not immediately shown the final shipping costs, but only during the ordering process after you have entered the shipping address. This is much better with ebay (see advantages and disadvantages of ebay)